Swing Trade Idea – July 10, 2025

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China,

Hong Kong – neutral global set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

· Yields: 30Y Bond +.08% Currencies: USA$ +.0%, CAD +.12%, YEN +.01%, BTC/USD -0.6%, Vix: 16.85

· Stocks: DAL+13%, CAG-4.6%,

HEL-25% EPS KLG+53% sale of company; TSM+1.25% Q2

revenue narrow beat MP+42% entered public/private partnership with DOD for rare earth

metals

Events: USA: UE claims 830ET; 30Y auction 13ET; Trump 50% Brazil tariff

Global Equities are mixed with USA and Europe flat, JP lower, and China

higher. Trump added more countries to the tariff list with Brazil standing out

50% which looks politically motivated and increases risk that courts may

ultimately rule against the WH in the future. Trump is talking a 50% tariff on

copper and with USA importing ½ of its needs, is pushing up copper prices. FCX

is a beneficiary of higher copper though ¼ of its copper is mined in USA. The

XME which holds miners and steel producers is higher as tariffs push up metal

prices (until tacoman returns:). Semis and AI continue to be bid and TSM Q2

revenue which was a hair greater than consensus provides another incentive to

bid up the usual suspects: NVDA, AMD, AVGO, MU along with fave ORCL and other

AI names. DAL has moved above the daily expected move by providing guidance

again which is very broad but shorts are getting burned and airlines are all

lifting. MP (previous idea) massive move on DOD deal as rare earth metals are a

meme. Biotech names were strong Wed and continuing today with ARKG higher and

CRSP continuing. Next gen finance remains a strong meme with FUTU TIGR, both

Chinese and SBET higher premarket. These join HOOD, CRCL and others which have

been very strong while the conventional financials weaken. XLF is at the bottom

of the weekly expected move which indicates speculation fever continues, for

how long I don’t know but the WH is stoking the fever and there are WH insiders

who will directly profit from the rise of non-traditional assets. SPX6300-6250

looks like the range based on positioning.

· Simple bull bear levels: SPY 622, QQQ 555, IWM 221

· SPY 624

Resistance 625 627 Support 622.8 621 620, QQQ 556.7 Resistance 560

Support 555 554 551

Daily Expected Move. SPX(6292-6234), SPY(627-621), QQQ(560-553), IWM(226-221)

Stocks to watch MSFT, AMZN, FCX, NVDA, GLD Speculative SOUN,

SBET, ENPH

Pre-800ET

Indices XME, ARKG, ARKK, IYT, MSOS, SLV, FXI, UNG, SMH, ARKF, IBIT, USO,

XLE, XLF

S&P500 DAL, UAL, LUV, FCX, ALB, AMD, ORCL, AMAT, TSLA, NVDA, CAG, PTC, ASK, WDAY, VZ, SWKS, T, NKE

Other KLG, MP, NRIX, AAL, TIGR, BEKE, CRSP, FUTU, SBET, RIO, BTI, BTDR, RARE, MBLY, BE, NU, PBR

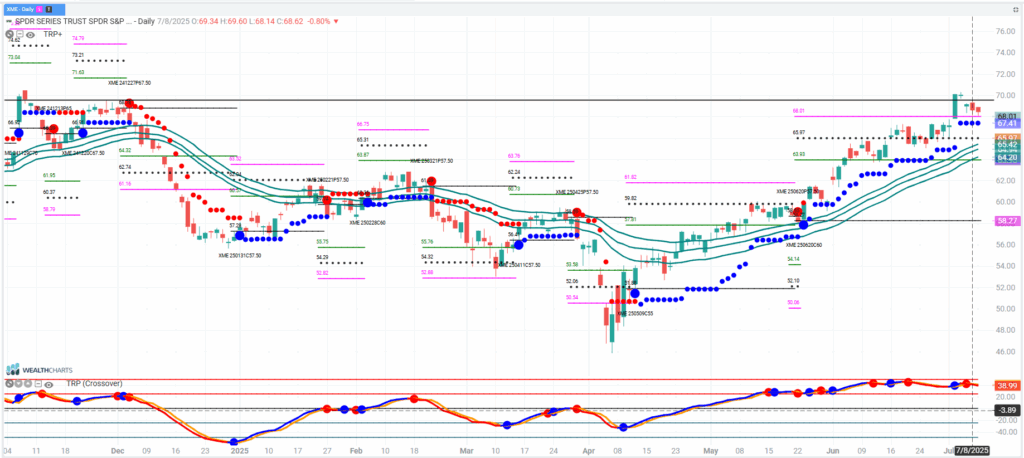

XME

XME is an ETF which holds steel and miners and benefits from tariffs and a potential improvement in China. Really a placeholder for companies like FCX, RIO, NUE, STLD. Metals benefit from weakness in the US$ and the Trump tariff policy as the USA cannot produce the metals/steel it needs and mines take 10yrs to come on line. Today miners are all higher so pullbacks could be better opportunities.