Swing Trade Idea – July 23, 2025

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong Kong – positive global

set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

· Yields: 30Y Bond -.30% Currencies: USA$ +.08%, CAD +0.17%, YEN +.14%, BTC/USD -0.6% Vix: 18.65

· Stocks: GEV+3.5%, GD+2.8%, TMO+1.96%, LII-3.2%, KO+.09%, TXN-10%, OTIS-6.4%, SAP-4%, T-3.8%, CNI-4.9%, ENPH-7.6%, FI-14%, NXPI-3% EPS

· Events: USA:

Japan trade deal wih 15% tariff, lower than Trump threat

Equity: Global indices higher led by Japan with a trade agreement with

tariff rate 15%. USA indices are led by IWM, continuing from Tues where market

rotated out of large cap momentum leaders into laggards. MAG7 are led by NVDA

and AVGO are bouncing after hitting the bottom of the weekly expected move.

GOOGL and TSLA report after the close. TXN beat estimates but guided lower

dragging down ON STM and other similar semis not named NVDA and AVGO. IWM

strength and meme stock strength is indicative of 2021 speculative fever

independent of fundamentals that can continue until actual data is

reported. The speculative names leading premarket are in the nuclear,

space, drones and quantum. GEV higher post earnings and deal between OKLO and

LBRT should provide a boost to the power generation space, VST, CEG, NUKZ and

XLU. China stocks continue to run with PONY higher on a robotaxi trial and BIDU

continuing to move higher. No major economic news expected today. SPX hit the

top of the daily expected move premarket and is short term extended with large

positive gamma 6330-6350 may lead to muted upside and chop today. Meanwhile in

meme land DNUT RKT KSS LCID BULL are competing with OPEN. Casino is open for

now and high short interest are targets until the music stops.

· Simple bull bear levels: SPY 630, QQQ 561, IWM 224

· SPY 631.3

Resistance 631 633 Support 630 627 626, QQQ 562 Resistance 565 566

Support 561 560 558

Daily Expected Move. SPX(6335-6283), SPY(631-626), QQQ(565-558),

IWM(225-221.7)

Stocks to watch NVDA, GEV, APH, TXN Speculative SMR, RKT,

PONY, GLXY, SBET, OPEN

Pre-800ET

Indices KWEB, EFA, ARKG, XLU, IWM, XBI, ARKX, ARKK, XLV, ARKQ, XBI, XLF,

XLI, UNG, USO, IBIT, SMH, TLT

S&P500 LW, GEV, APH, VST, MRNA, GM, CCL, NVDA, PLTR, FI, TXN, ENPH, MCHP, ON, T, VZ

Other SMR, PGY,

PONY, RKT, SONY, ACHR, GLXY, OKLO, RKLB, IONQ, JOBY, NVO, BIDU, QBTS, LUNR, STM, MARA, U,

QS, KSS, OSCR, SRPT

WallstBets RKT, DNUT, KSS, LCID, TLRY, RKLB, BULL

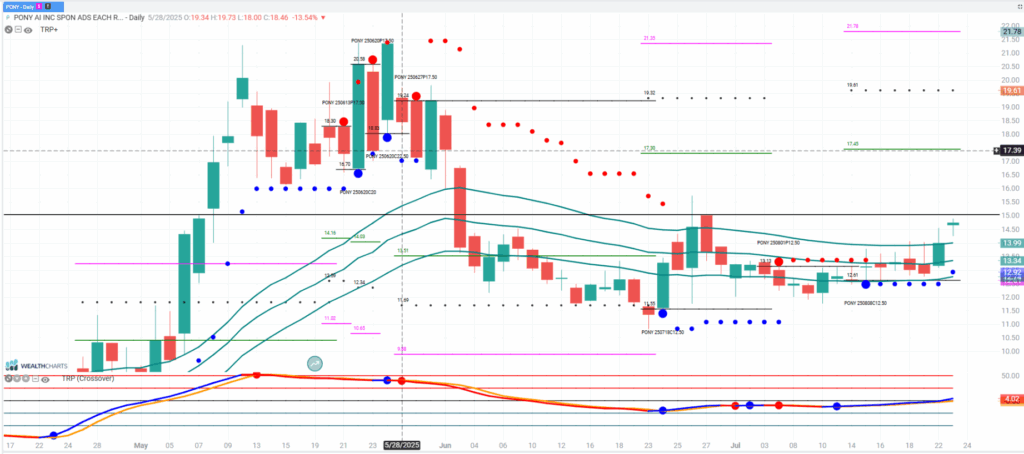

PONY

PONY is a highly speculative China autonomous driving company which announced a Gen7 robo taxi trial in Beijing. Large call position at 15 which can lead to a run to 16+. This type of name is very risky and predicated on the casino remaining open. OTM call IV is elevated which gives call verticals a better reward to risk and a way to trade high IV names.