Swing Trade Ideas – July 31, 2025

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong Kong – neutral global set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

· Yields: 30Y Bond +.44% Currencies: USA$ -.02%, CAD -0.18%, YEN-.42%, BTC/USD +1.45%, Vix: 17.35

·

Stocks:BUD-10%, SNY-4.7%, IP-7%, BLDR-8.8%, QCOM-5.8%, CFLT-30%, SHAK-10%,

ARM-7%, HOOD-1.7%, MSFT+8.4%, META+11.7%, CVS+7%, APLD+22%, RBLX+18%, CVNA+16% EPS

Events: USA: PCE 830ET; CDN:GDP830ET

Equity: Global equities are weak ex-USA with S&P500 and Nas100 above

the daily expected move after multi-standard deviation moves by META and MSFT.

SPY hit the bottom of the daily expected move Wed post Powell before bouncing

as 0DTE puts were closed. Powell was perceived as hawkish which led to a

higher US$ and reduced rate cut expectations. Higher US$ is negative for

commodities and foreign equities. Copper is -22% as Trump taco’d on 50% tariff

on refined copper which is killing the longs. A “deal” was signed with Korea

with tariff 15% and $350B tribute to be paid. MSFT move was 2.5x expected and

META 2x with earnings beat and lifting the usual AI suspects NVDA AMD ORCL.

MSFT CEO comment that gaining cloud market share is pressuring GOOGL.

Often moves by large market caps will suck capital from other stocks. MSFT CEO

also mentioned quantum which gives an excuse to bid them higher (QTUM). All

isn’t bright in semi land with QCOM and ARM lower and weakness in semi

equipment names. Speculative squeeze names APLD CVNA RBLX TMDX CRWV SHAK. SPX 6430

is a level to watch with potential for a squeeze higher above to 6450. There is

still a vol premium into AMZN AAPL earnings and NFP Fri so benign NFP and OK

earnings can move SPX to 6500 by Aug Opex. Powell is powerless vs AI

wagon!

SPY 640.2 Resistance 642.8 645 Support 640 638.4 635 QQQ

575.6 Resistance 577 580 Support 575 570

Daily Expected Move. SPX(6403-6323) SPY(638-630) QQQ(573-563)

IWM(224-219)

Stocks to watch META, MSFT, NVDA, EBAY, NCLH, QCOM Speculative

APLD,

CVNA

Pre-800ET

Indices ETHE, XLC, XLK, IBIT, QQQ, ARKF, GLD, SPY, IGV, QTUM, ARKK, GDX, SLV, USO,

XLE, KRE, XLB, IWM, SMH

S&P500 EBAY, META, NCLH, MSFT, CVS, WDC, CMCSA, ABBV, BMY, SMCI, COIN, AMD, NVDA, ORCL, ALGN, PARA, LRCX, QCOM, AMAT, DDOG, LLY, UNH

Other APLD, ALHC,

TMDX, CVNA, CRWV, TAL, RBLX, BBVA, KC, RGTI, QUBT, IREN, QBTS, RDDT, CFLT, BUD,

SHAK, BTU, ARM, ASML, HOOD, STM, AZN, VFC

WallstBets NVDA, META, MSFT, AAPL, CVNA, HOOD, RDDT,

APLD, RBLX

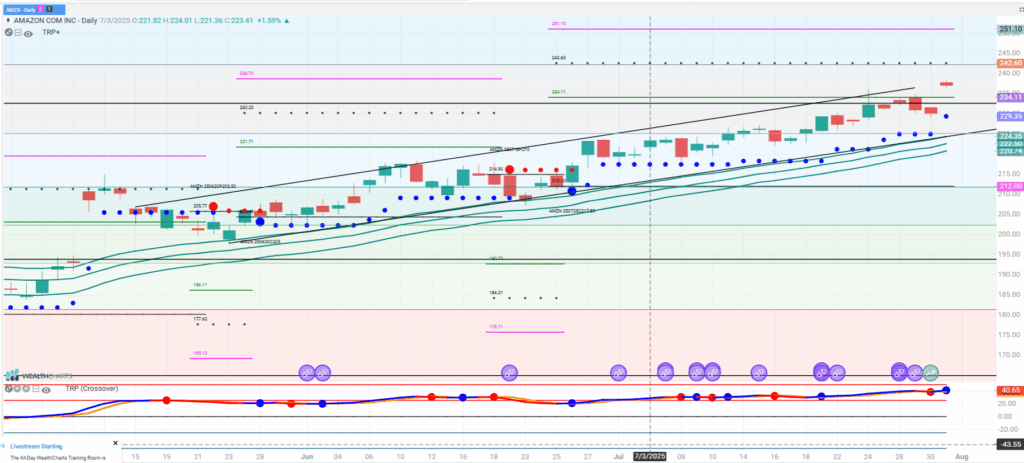

AMZN

AMZN reports after the close. Expected move +/- 11.4. AWS revenue will be in spotlight after MSFT CEO comment that Azure is gaining market share from competitors. Impact of China tariffs will also be a focus. Large call position at 240 can act as resistance or lead to an outside move to 245/250. Below 220 can lead to a larger move to 210. Butterflies are a trading idea with high reward to risk with Fri expiration. Can offset the fly to remove the risk of a larger than expected move ala META and MSFT.