Swing Trade Ideas – September 29, 2025

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong Kong – Positive set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

· Yields: 30Y Bond +.51% Currencies: USA$-0.14% CAD +0.03% YEN+.47% BTC/USD+2.7% Vix: 17.5

·

Stocks: CCL+1.7% EPS USA govt shutdown potential by Oct 1

Events: USA: Fed speakers all day, both doves and hawks Trump:

Tweeted post in support of Cannabis for medical purposes

Equity: USA indices popped Sunday to the upper daily expected move,

hence extended with higher probability to retrace but squeeze higher is

possible. Macro is supportive with yields and US$ lower potentially due to

concern of a USA govt shutdown Oct 1. Bitcoin, gold, silver, copper are all

higher and close to the upper daily range along with gold miners. MAG7 is led

by NVDA and AMZN and the usual cohort of AI related names like AVGO PLTR

OKLO and speculative ETFS like ARKK and ARKF are bid indicating

risk-on premarket. China is bid higher with KWEB strong and BABA strong.

Speculative nuclear, quantum, bitcoin treasury names are all bid premarket and

the question is whether it’s a sell the pop day or whether the move has legs.

End of quarter Sept30 can be a window dressing event where winners are bought

into EOQ and laggards sold with reversion in the new quarter so may have legs.

Cannabis (MSOS) +20% after a Trump tweet on CBD as a medical treatment and

raising hope for the nth time that the USA federal govt may move to legalize.

This week is jobs report week and with the market fixated on employment with

hope that weak jobs leads to rate cuts and stocks higher may see some higher

vol this week. Today there is no econ data so 0DTE traders are in control and

SPX6670 is the major level to watch as a bull bear dividing level. CCL is the

only earnings name of note with print TBD

SPY 664.8 with Resistance at 664.7, 665, and 667 and Support at 663 and 660 QQQ

599.5 with Resistance at 600 and 602 and Support at 597 595, 594, and 591

·

Daily Expected Move. SPX(6672-6615) SPY(664.7-659)

QQQ(600.4-591.5) IWM(243-239.4)

Stocks to watch AMZN, NVDA, TSLA, PLTR, NVO Speculative USAR, MSOS,

OKLO, IREN

Pre-800ET

Indices MSOS, GDX, IBIT, KWEB, SLV, ETHE, GLD, ARKK, XME, ARKF, IP,

ARKG, UNG, UUP, XLE

S&P500 CCL, PLTR, NVDA, HOOD, INTC

Other MRUS, USAR, OKLO, AG, CIFR, SMR, IREN, BABA, BMNR, TIGR, UEC, QUBT, MLTX, NVO

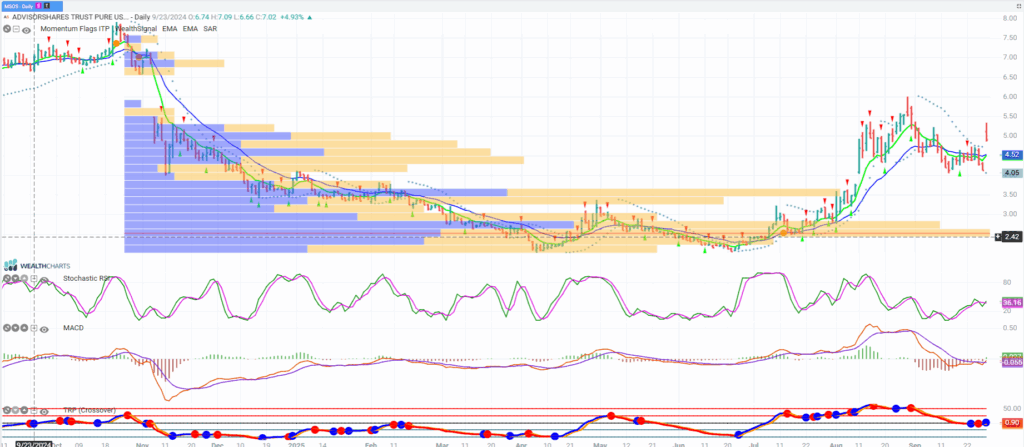

MSOS

MSOS is a Cannabis ETF which started to breakout in Aug on hope on Trump positive comments and up 20% premarket on a tweet, on medical benefits of CBD. There have been a lot of false starts over the last 5 yrs but the hope is that the USA Federal govt will reclassify cannabis to the benefit of the industry. It is a very volatile ETF but does have options and the call skew allows for call verticals with better reward to risk and the volatility is suitable for selling puts. Momentum traders can look for a move > 5 with upside target 5.5, 6 or alternatively look for pullback > 4 for a dip entry. TOKE is an alternative ETF but with limited option liquidity.