Swing Trade Ideas – October 2, 2025

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong Kong – Positive set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

· Yields: 30Y Bond +0.16% Currencies: USA$ -0.1% CAD -0.01% YEN+.23% BTC/USD+1.18% Vix: 17.4

·

Stocks: EFX, TRU -11%, FICO +19% circumventing STLA+6.5% US sales

higher FRMI+4.4% IPO Wed

Events: USA: Challenger: Planned job cuts dropped 37% m/m but

hiring plans lowest ytd since 2009;

Equity: Global indices higher premarket following Mon reversal. Wed ADP

jobs report was weak as was the mfg PMI which fuels the Fed rate cut hope but

AI fever remains the dominant meme. Tues breadth was weak but squeezed in NVDA

TSLA along with healthcare lifted indices. The USA govt is still shutdown and

will delay the non-farm payroll data which the market is fixated on hence the

casino is in the hands of 0DTE traders. While SPX > 6700 bulls are in

control with < 6880 a caution level. Many warning signals are building with

1m SPX correlation close to lows, S&P short term implied volatility

<< Vix and many single stock skew tilted to calls with IV rising. It’s a

setup that can lead to a blow-off top or a sharp drop with the market

increasingly sensitive to an increase in volatility but catalyst TBD. One can

trade the upside chase with call verticals that take advantage of the skew and

reduce risk if/when the catalyst emerges. MAGS are led by NVDA TSLA AVGO with

NVDA and TSLA well above weekly expected moves and approaching key levels. AI

data center related names are higher with MU squeezing Wed and STX and WDC

continuing. NBIS is today’s AI name with a MSFT deal which has the algos buying

anything AI related. With the SPX very extended (IMO) and correlation

very low, it usually results in weakness in other sectors e.g. financials Wed.

Bitcoin higher lifting related names, US$ lower and precious metal chase

unrelenting. The speculative ETFs are led by ARKK (TSLA) and Quantum but in

reality it’s the same trade i.e. liquidity abundant and US$ lower is a green

light for momentum chase until the music stops, which needs a catalyst to move

vol higher. Since my indicators are warning, call spreads and call flies are a

way to trade the froth

SPY 670.6 with Resistance at 671, 675, and 677 with Support at 670, 668, and

665 QQQ 607 with Resistance at 608 and 610 and Support at 602, 600, and 599

Daily Expected Move. SPX(6740-6682) SPY(671-665) QQQ(608-599)

IWM(244-241)

Stocks to watch AMD, AVGO, TSLA, NVDA, TRU Speculative PL, NBIS,

APLD, CIFR

Pre-800ET

Indices KWEB, ARKK, SMH, QTUM, IBIT, ETHE, GDX, ARKG, XLK, ARKQ, MAGS, UNG, XLV,

XLP, UUP

S&P500 AMD, AVGO, TSLA, NVDA

Other PL, NBIS, APLD, CIFR, AMD, IONQ, BMNR, BABA, RGTI, CRWV, AVGO, SOUN, MARA, TRU

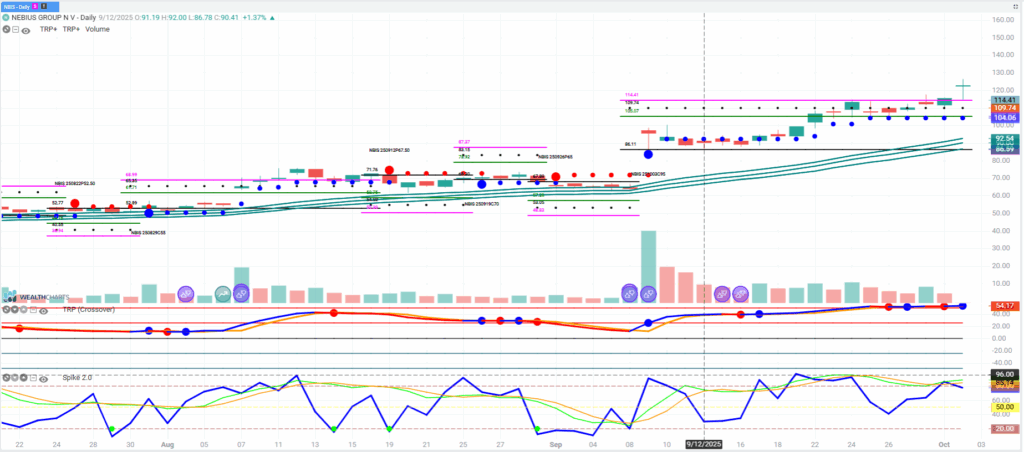

NBIS

NBIS is a Netherlands based AI company which is higher on a deal with Microsoft involving > 100k NVDA GB300 GPUs. NBIS is building AI datacenters in the USA but is more than a data center company. Stock is extended premarket as are indices and other AI names so potential for retracement. There is a call wall at 120 which is a set-up for a squeeze above with targets 124 and 130. Pullback supports 120, 115 so can look for pullbacks for long trades. NVDA is the king and can be used as an indicator for the AI appetite