Swing Trade Idea – June 18, 2025

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China,

Hong

Kong – slight negative global set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

· Yields: 30Y Bond +.19% Currencies: USA$ -.16% CAD -.11% YEN+.37% BTC/USD +.5% Vix: 21.35

· Stocks: CRCL+2.9% Genius

Act passed MRVL ADI upgrades

News: USA: UE claims, Housing starts 830ET; FOMC 14ET; Next

move by Trump vs Iran TBD, market not concerned for now; USA passed the Genius

act for regulating stable coins CRCL has been moving higher in anticipation

Overview: USA indices are relatively flat ahead of FOMC meeting

and the next move by the USA in the Iran-Israel conflict. USA initial UE claims

245k inline and continued claims 1.945M above expectations. Housing starts and

building permits below expectations. TLT rose Tues with potential USA war

escalation and weaker USA economic data. MAG7 are marginally higher premarket

led by TSLA and NFLX, the latter which has been very strong. Semis continue to

be a sector attracting buyers with AMD MU strong and today MRVL and ADI higher

on upgrades. They seem to be rotating into the industrial, less sexy semi

names. Retail and short term hedgies are still buying meme sectors like

nuclear, quantum and space with SMR QUBT RGTI ASTS higher. Caution that there

is a trend for these names to be pumped in the morning and dumped later in the

day. FOMC should be market moving and with IV elevated into the meeting and

normally potential for bounce post if Fed does not provide a negative surprise;

however Trump war escalation can dwarf and keep IV elevated. Crude and natgas

robust as long as USA is waving a sword. SPX 0DTE positions at 6035 and 5915

are potential targets today with 6000 continuing to be a strong pivot level.

Simple bull bear levels: SPY 600 QQQ 530 IWM 210

· SPY

598.3 Resistance 600 603 605 Support 597 596 595 QQQ 530.2

Resistance 532 533.2 535 Support 530 527 525

Daily Expected Move. SPX(6042-5923) SPY(603-592) QQQ(535-534)

IWM(212-205)

Stocks to watch MRVL, AMD, BABA Speculative QUBT, ASTS, IONQ

Pre-800ET

Indices UNG, IBIT, SMH, EFA, USO, TLT, ARKK, XLK, QQQ, KWEB, FXI,

ETHE, UUP

S&P500 AMD, MU, ORCL

Other MRVL, SMR, QUBT, ASTS, RGTI, BTDR, BABA, IONQ

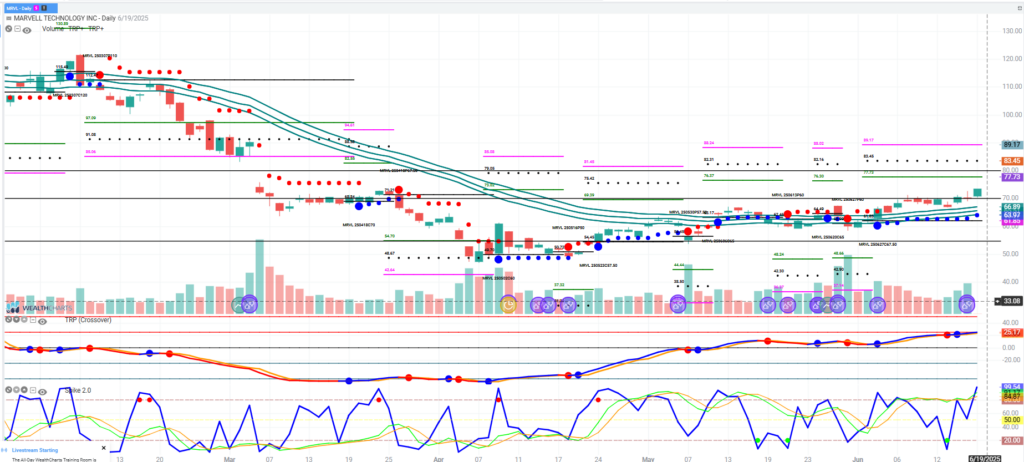

Trade Idea: MRVL

The USA equity market has a clear preference for semis and appear to be broadening. MRVL has been a laggard and they recent upgrades have pushing it higher. MRVL pushed above the 72 short call wall which can squeeze it to 74, which is the next large call position. MRVL financials are not great but irrelevant as it’s a semi and a laggard therefore buy:) The 200sma is at 83 with a unfilled gap to 85 which will excite the technical types.