Swing Trade Idea – June 24, 2025

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China,

Hong Kong – positive global set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

· Yields: 30Y Bond -.27% Currencies: USA$ -0.4%, CAD +.18%, YEN +.83%, BTC/USD +2%, Vix: 19.75

·

Stocks: KBH-1.6% EPS

News: USA: Trump announced an Iran Israel ceasefire;

Powell testimony 10ET Canada: CPI 830ET

Overview: Global indices bounced post Trump announcing an Iran

Israel ceasefire. Oil, gold, defense, bonds, US$ are lower and airlines/travel,

foreign stocks and speculative stocks higher. USA indices are at the top of the

daily premarket which can lead to a trend day higher or reversion. SPX >

6085 can lead to 6100 and first support level 6050 and then 6020. MAG7 are

again led by TSLA following up from Mon surge (yesterday’s idea) , AMZN, AAPL,

GOOGL. Semis are still bid with insatiable MU buying ahead of earnings and

AMD as analysts go back to the well. NVDA more subdued with 145 a key

level. FI signed a deal with MA which is lifting both names and adding

fuel to the stable coin frenzy. CRCL, the ring leader is pulling back premarket

and worth watching as its very extended but retail are enamored with it. In the

speculative basket the nuclear, quantum, bitcoin names are bid so premarket

it’s a setup for a short covering rally. Caveat is the drop in volatility due

to the cease fire leads to a mechanical bid to indices and not necessarily

“real” buying and more missiles can reverse in a minute. Powell is testifying

over the next 2 days, likely a repeat of FOMC meeting where FED position is to

wait and watch but market is now pricing in the odds of a July rate cut to 25%.

Tariff policy is still in the courts which is adding to macro uncertainty.

Simple bull bear levels: SPY 600, QQQ 530, IWM 210,

·

SPY 594 Resistance 595 597 600 Support 591, QQQ 526

Resistance 530 531 533 535 Support 525 523

Daily Expected Move. SPX(6064-5986), SPY(604-596), QQQ(536-527),

IWM(214-210)

Stocks to watch FI, TSLA, AMZN, AMD, AAPL, UBER, NEM, OXY Speculative

ZETA,

UPST, GFI

Pre-800ET

Indices ETHE, IBIT, SMH, ARKK, QTUM, KWEB, ARKF, ARKG, QQQ, XLY, USO, GDX,

GLD, UNG, XLE, UUP, SLV

S&P500 FI, UBER, MU, AMD, UAL, CCL, MA, SMCI, AVGO, ANET, TSLA, DAL, COIN, ALB, NEM, OXY, APA, XOM, LMT, RTX

Other ZETA, LYFT, EDU, SMR, PGY, KC, UPST, OKLO, GLXY, IREN, QUBT, DB, DLO, RGC, RVMD, AU, HMY, GFI, FRO, EQNR, AAP

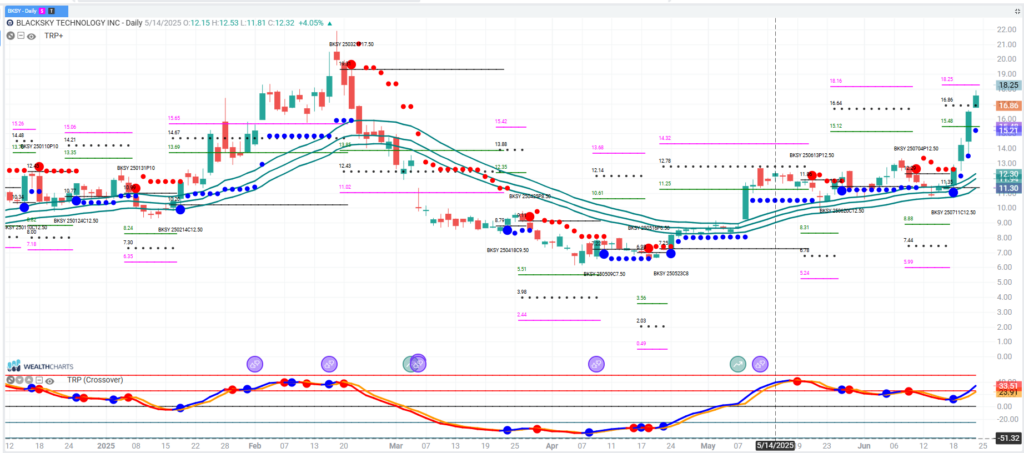

Trade Idea: BKSY

BKSY is a space intelligence company which provides geospatial intelligence. Recently signed a deal with RKLB. The Trump protection dome and the geopolitical shenanigans are sparking the crowd to chase defense and space related names. This is very very speculative but traders have been piling into Aug 20, 25, 30 calls looking for upside. Maybe thinking it can be a Palantir type company. No personal due diligence on the name so caveat emperor.