Swing Trade Ideas – August 1, 2025

Date:Aug 1, 2025

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong Kong – negative global set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

· Yields: 30Y Bond -0.5% Currencies: USA$ +.16%, CAD -0.17%, YEN+.23%, BTC/USD -1.6%, Vix: 18.95

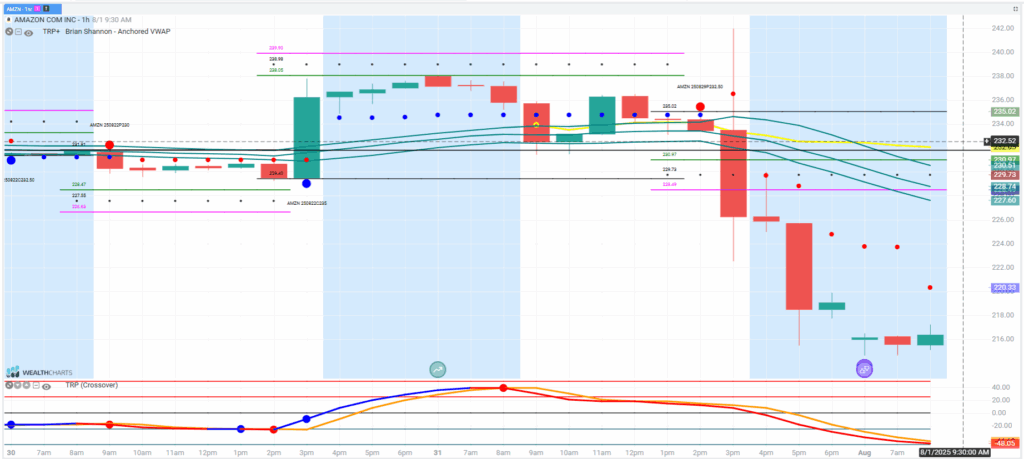

· Stocks: AMZN-7.9%,

COIN-10%, FLR-15%, MSTR-1.9%, ROKU-3%, RDDT+15%,

AAPL+1.85% EPS

Events: USA: NFP 830ET; mfg PMI, consumer sentiment 10ET CDN:

mfg PMI 930ET

Equity: Global indices are lower ahead of non-farm payroll data with

catalysts Trump new tariff salvo, AMZN lower post EPS and volatility

increasing. AMZN beat estimates but AWS margin was lower than expected and

capex was not increased. Latter is a negative for NVDA, AMD as maybe an

infinite amount of money won’t be spent on chips. AAPL is higher post EPS with

better than expected results and along with MSFT is the only positive MAG7.

MSFT share gain in cloud is being rewarded. Earnings movers: COIN -10%,

FLR-16.7%, RDDT+14.6% moved more than expected move. General risk-off premarket with

IWM, ARK, bitcoin leading to the downside. Since April lows, the most shorted

companies have made large gains as retail bought and squeezed shorts. Question

is whether this is a dip to be bought or the start of a larger move. Should

NFP, PMI not be outsized negative, the increase in volatility and hedging can

lead to another bounce to burn the bears; however, there is always risk of

follow-through. SPX 6300 is a bull/bear level today. *** non-farm payrolls 73k

vs 104k ; UE rate 4.2% Reaction: TLT bounce, US$ lower; SPY holding the

bottom of the daily expected move and 625 put wall *** Note PMI and

consumer data 10ET will be market moving.

SPY 627.5 Resistance 630 635 637 639 Support 625 620, QQQ 559.5

Resistance 560 564 565 566 569 Support 559 557 555

Daily Expected Move. SPX(6405-6274), SPY(639-625), QQQ(571-559),

IWM(222-216)

Stocks to watch KMB, AAPL, NEM, COIN, AMZN, AMD Speculative RDDT, FIG

Pre-800ET

Indices GLD, US$, ARKF, ARKK, ETHE, ARKQ, XLY, KWEB, ARKX, SMH, IBIT, IWM, QTUM, KRE,

QQQ

S&P500 KMB, AAPL, NEM, LLY, COIN, AMZN, MRNA, SMCI, AMD, TTD, VST, MU, GEV, XYZ, IR, NCLH

Other FIG, RDDT,

NVT, RKT, BTI, NVO, QFIN, FLR, ENVX, INOD, BE, GLXY, RIOT, SMR, FUTU, HUT,

HIMS, APLD, IREN, RKLB

WallstBets FIG, UNH, AMZN, RDDT, WEN, NVO

AMZN

AMZN lower despite earnings beat but weaker AWS margins and Capex being held flat was deemed negative. AMZN has moved below the expected move. Straddle approach with long > 217.5 with target 220 and above 220 potential for a strong bounce and fade < 215 with target 210. 50sma is 217.5 and 200sma 209.5, levels with some eyeballs