Swing Trade Ideas – August 14, 2025

Date:Aug 14, 2025

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong Kong – neutral set-up

- Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

- Yields: 30Y Bond +0.35% Currencies: USA$ +0.01% CAD -0.09% YEN+0.58% BTC/USD -1.7% Vix: 15.6

- Stocks:JD+0.8% DE-6.7% COHR-18.5% NTES-6% TPR-16% EPS

Events: USA: PPI 830ET; Trump 13 ET UK: GDP better than expected

Equity: USA indices flat ahead of PPI print premarket. Wed was a rotation day with small caps and laggards outperforming resulting in IWM above the weekly expected move; SPY at the upper expected move; QQQ hitting the top of the weekly expected move and EWC at the top. MAG7 are mixed led by TSLA MSFT AAPL. MSFT META TSLA pulled back from the top of the weekly expected move Wed. Algos are rotating daily between the MAG7 and there is a lack of correlation suggesting distribution. SMH (semis) are also at the top of the weekly expected move despite NVDA flat indicating rotation within the sector. NVDA is a candidate to make a move ahead of earnings. Earnings movers: DE COHR TPR DLO have moved outside the expected move and hence candidates to watch. Bitcoin is pulling back from highs reached overnight along with silver suggesting potentially a risk-off open that will depend on the PPI print. The market has latched onto the Fed rate cut meme despite CPI IMO not indicating inflation has peaked with the Pavlovian reaction of buying small caps, housing, regional banks. A lower PPI will add confirmation bias but a higher PPI may lead to a negative reaction. TLT is higher premarket and will react to the PPI print. MAG7 may be the beneficiary of a higher PPI with challenge that every day the algos target a different name and there is a tendency to sell some names and buy others. Large 0DTE SPX iron condor with 6490 6440 sets likely targets for today with a breach of those levels leading to outsized moves. QQQ being the only index not at the top of the weekly expected move is a candidate to outperform if rotation game continues.

SPY 644.5 Resistance 645 648 Support 643 642 640 QQQ 580.4 Resistance 581.8 584.1 Support 579 576 575

Daily Expected Move. SPX(6497-6436) SPY(648-642) QQQ(584-576) IWM(233-229)

Stocks to watch AMD KWEB SLV PLTR Speculative TIGR FUTU CAVA

Pre-800ET

Indices MSOS TLT USO IBIT KWEB UNG SLV ETHE ARKF IWM GLD

S&P500 CSCO TPR

Other DLO JD SMR COHR ATNF LUNR TPR SBET IBIT SOUN RIOT CSCO BABA

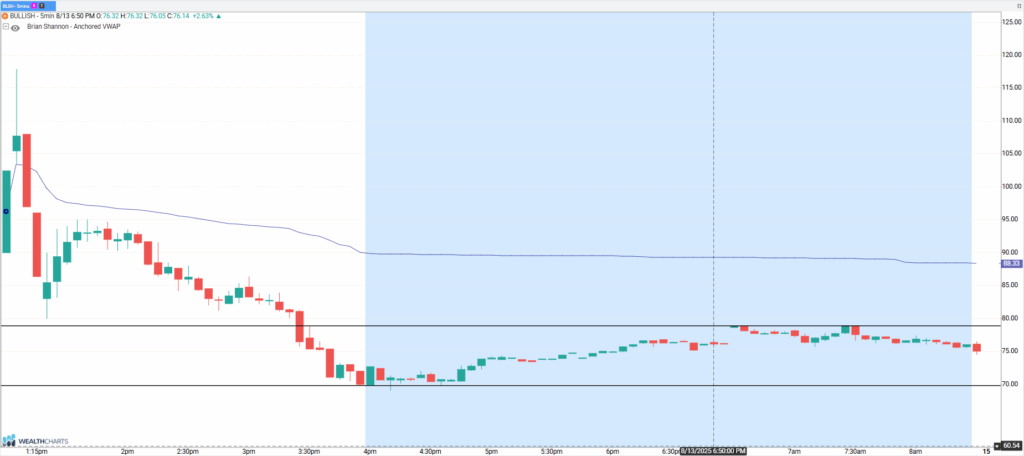

BLSH

Bullish (ticker: BLSH) is a Cayman Islands-based cryptocurrency exchange and digital asset platform that went public on August 13, 2025, on the New York Stock Exchange (NYSE). The company, founded in 2020 and operational since 2021, is backed by prominent investors, including Peter Thiel’s Founders Fund, BlackRock, ARK Investment Management, Nomura, and Mike Novogratz.

BLSH is the latest retail shiny object. Levels to trade are: long > 79 premarket high with target vwap 88. Premarket low 70 is a level for a bounce or fade below. Note this is a crypto related name and hence should be correlated. ** Very speculative **