Swing Trade Ideas – September 2, 2025

Date: Sep 2, 2025

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong Kong – negative set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

· Yields: 30Y Bond -0.8% Currencies: USA$ +0.58%, CAD -0.43%, YEN-1.1%, BTC/USD+1.15%, Vix: 17.8

· Stocks: SIG+3.6%,

NIO+.9%, ASO-5.7% EPS

Events: USA: PMI 9:45, 10ET; Trump tariffs ruled unconstitutional

by appeals court, Supreme Court next Europe: CPI data higher

Equity: USA and global indices are generally lower ahead of USA PMI data

today. SPY and QQQ are below the daily expected move and at risk to continue to

trend lower. SPX6400 is a level to watch with 6325 the level attracting 0DTE

put selling below and a potential target. The US$ and 30Y yields are

substantially higher which weighs on risk assets. Potentially just first of

month flows or reaction to higher European yields and news reports of potential

IMF bail outs of France and UK or the tariff uncertainty. The PMI data at 10ET

may be market moving. Precious metals and bitcoin are higher which is unusual

given the macro set-up and may be a risk-off move. MAG7 are lower led by NVDA

which is continuing the post earnings weakness potentially fueled by BABA AI

chip news. Note that QQQ and S&P sectors are rebalancing Sept 19 which can

result in weighting reduction of the largest MAG7 names. There are clear signs

of hedging increasing with jobs data this week and upcoming Fed meeting and of

course the tariff uncertainty. This can lead to sharper moves in either

direction with the bulk of large index moves occuring once put positions

unwind. Flip side is potential for large down moves if major put levels are

breached. Pay attention to reaction at 10ET and SPX6400 and keep an open

mind. Since US$ and 30Y are driving the move, they are good signals to watch.

SPY 639.2 Resistance 642 643 644 645 Support 637 635 QQQ 563.5 Resistance 567

570 Support 563 560

Daily Expected Move. SPX(6505-6415), SPY(650-640), QQQ(575-565), IWM(237-233)

Stocks to watch PEP, GDX, BABA, IBIT, NVDA, AMZN, TSLA Speculative

UTHR,

CRWV,

JOBY, OKLO

Pre-800ET

Indices GDX, SLV, XBI, IBIT, GLD, $US, UNG, MSOS, SMH, MAGS, TLT, XLK, EFA,

ARKK, QQQ, KRE, IGV

S&P500 PEP, CCL, SMCI, PLTR, INTC, NVDA, AMD, TSLA, AMZN, GOOGL

Other UTHR, MLYS, CYTK, IONS, INSM, AL, PEP, LQDA, B, IBIT, MARA, CRWV, JOBY, OKLO, APLD, ZETA, NBIS, SMR, RKLB, TEM, SOFI, IONQ, SOUN, OSCR, MRVL, TSLA

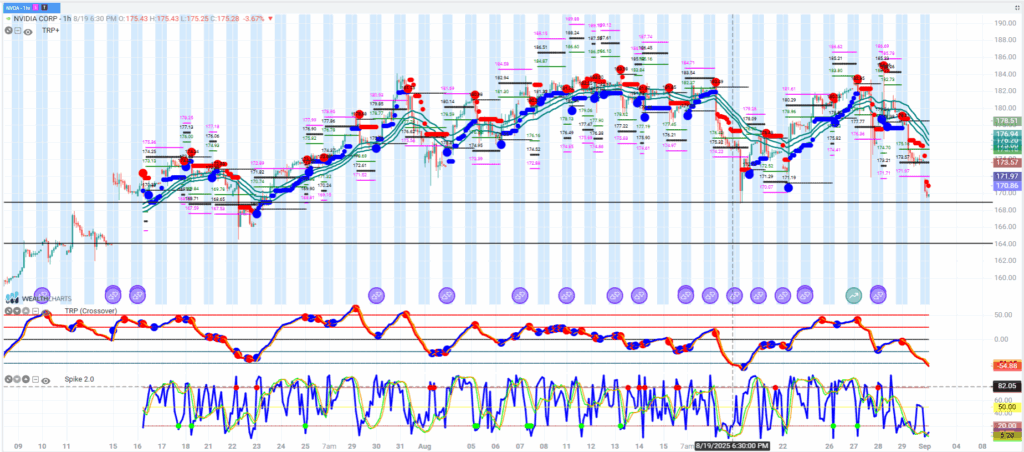

NVDA

NVDA has major level with 170 the key bull bear level, which is a large option level and the bottom of the daily expected move. Below 170 potential for 165 and 160 and above 172 potential to return to the Fri close. Note that index rebalancing on Sept 19 can lead to a reduction in NVDA weighting which necessitates selling by indices. BABA AI chip along with China export restrictions, are adding uncertainty to NVDA future revenue.