Swing Trade Ideas – September 8, 2025

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong Kong – positive set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

· Yields: 30Y Bond +0.05% Currencies: USA$-0.09%, CAD +.34%, YEN-0.18%, BTC/USD+0.32% Vix: 16.5

· Stocks: HOOD +8.3%,

APP+9%, EME added to S&P500; ORCL+2.3% earnings

Tues; SATS+22% terminates $1.3B MDA contract and sells spectrum to SpaceX for

$17B ASTS-12% reaction

Events: USA: no major reports

Equity: Global indices are generally higher premarket with long yields

and US$ lower ahead of the inflation reports this week and heightened

expectations of FED rate cuts. MAG7 led by TSLA, MSFT, AVGO. AAPL has an

I7 event Tues and may see some monkey buying into the event. Gold miners

continuing to be bid with the expectation of a lower US$ and lower rates, but

they are becoming very extended. China stocks are bid in the Hong Kong market

with BIDU, BABA et al bid overnight. Oil is higher despite Opec increasing

production, as is natgas and lifting producers like APA. S&P rebalancing is

adding HOOD, APP, EME to S&P500 and removing ENPH, MKTX, CZR. Added to

S&P400 NTNX, TRU, MP, KTOS. These names are candidates for today, with

names added to indices tending to rise,e with the caveat that HOOD, APP rumored

for many months to be added to the S&P500.

·

· SPY 648.6 Resistance 649.12 650 Support 647.7 646 645, QQQ 578.3 Resistance 580 Support 576.5 575 572

· Daily

Expected Move. SPX(6509-6454), SPY(650-645), QQQ(580-572), IWM(240-235)

Stocks to watch: TSLA, AVGO, HOOD, APP, SATS, ORCL, ASTS, RKLB, T Speculative

HMY,

GFI

Pre-800ET

Indices UNG, KWEB, MSOS, GDX, ARKK, SLV, GLD, MAGS, EFA, XLK, XLE, ETHE, US$

S&P500 ORCL, ALB, TSLA, AVGO, APA, BA, GEV, UNH, CEG, SLB, DVN, MSFT, T, TMUS, VZ, NCLH, NEM, CCL, MU

Other SATS, APP, HOOD, BIDU, HMY, GFI, BABA, XPEV, RDDT, ORCL, SMR, TSLA, AVGO, SMMT, ASTS, T, RKLB, VZ, MSTR, NVO

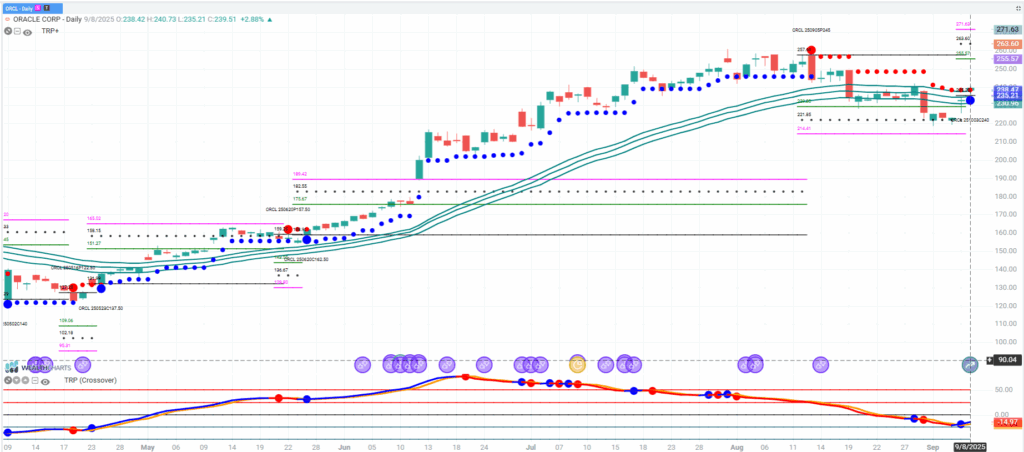

ORCL

ORCL reports earnings after the close Tues. Software has been weak but the monkeys like to buy stocks into earnings. ORCL is an AI name and it’s forecast will be important for the space including the capex for the large project partnering with Softbank. Expected move for the week is +/-22. ORCL large bounce Fri and in premarket. 240 is a large option level which can act as resistance or acceleration above. Can consider long > 240 or pullback > 235 as a pre-earnings trade.