Swing Trade Ideas – September 10, 2025

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong Kong – neutral set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

· Yields: 30Y Bond +0.98% Currencies: USA$+0.03%, CAD -0.09% YEN-0.07% BTC/USD+0.95% Vix: 16.25

· Stocks: SNPS -23%,

CHWY-7.6%, ORCL+32%, GME+8.9% EPS

Events: USA: PPI 830ET; 10Y bond auction 13ET; Supreme court will

decide today on whether to look at the Trump tariff legality which have been

ruled legal by the appeals court. If they will, a final ruling is expected late

2025 or early 2026.

Equity: USA indices higher ahead of PPI data premarket and more

important CPI data tomorrow. Today’s big driver is ORCL which as moved 3-4

standard deviations higher after weaker earnings but an uber forecast. TSM

monthly revenue upside surprise positive for semis. ORCL + TSM = monkeys buying

AI software and semis with NVDA AMD MU in semi space; CRWV SMCI ANET PLTR

OKLO in AI basket all higher. The large move in a few of the largest

names will suck the capital up and weigh on the remainder of the index. SNPS,

one of 2 companies that provide the chip design software down 3 standard

deviations after earnings is one to watch. *** PPI lower than expectations led

to a bounce in both equity and bonds.*** SPY above the upper expected move

hence potential for a squeeze higher if call buyers step up today but

alternative is sell the pop with CPI tomorrow a reason to derisk. SPX 6545 is a

large position which can be used as a bull/bear level. 10Y bond auction 13ET

potentially market moving

· SPY 652.8 Resistance 653 654.5 Support 651 650 647, QQQ 582.8 Resistance 585 Support 580 577

· Daily

Expected Move. SPX(6543-6482), SPY(653-647), QQQ(584-577), IWM(239-234)

Stocks to watch ORCL, NVDA, AMD, PLTR, TSM, SNPS, CHWY Speculative

GME,

BE, CRWV, IVTX

Pre-800ET

Indices IGV, XLK, GDX, IBIT, ETHE, GLD, SMH, XBI, UNG, KRE,

XLF, IWM, TLT, XLB

S&P500 ORCL, AMD, NVDA, AVGO, PLTR, ANET, MU, SMCI, MSFT, SNPS, TTD

Other IVTX, CRWV, GME, BE, SMR, RKT, TSM, ING, HIMS, ASTS, OKLO, CRCL, NVO, CHWY, RGTI, XPEV, BABA

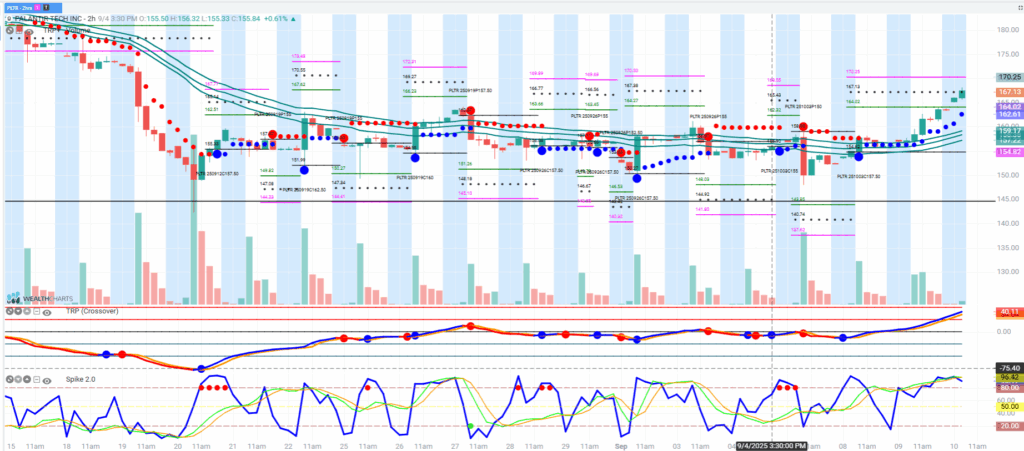

PLTR

PLTR is higher premarket on the combo ot ORCL earnings which will cause AI algos to buy the basket and a small contract. One of the highest targets for short term option traders, it’s susceptible to squeezes and is loaded up with calls at higher strikes. Strikes are every 2.5 so > 167.5 look for 170 or pullback to 165 or lower for long bounce trades. A deeper pullback to 160/155 would be preferable for a longer term trade. Caveat that it’s an extremely expensive stock which can do well in a risk-on environment which benefits hedge fund shorted names but susceptible if at some time valuations matter.