Swing Trade Ideas – October 6, 2025

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong Kong – Neutral set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

· Yields: 30Y Bond -0.48% Currencies: USA$ +0.66% CAD -0.03% YEN-1.8% BTC/USD+1.3% Vix: 17.7

·

Stocks: AMD +35% Deal with OpenAI for $100B revenue over 4 yrs and can buy 10% of

AMD for 0%

Events: JP: New PM is seen as dovish which has led to a large

drop in the Yen EUR: French PM resigned weakened Euro

Equity: USA indices higher led by Nasi. US$ higher as Yen and Euro fell

on changes in PMs which normally is negative for equity. Long yields are also

higher which is also usually negative. OpenAi is again the catalyst with the

latest news is a deal with AMD for $100B over 4 years which also allows OpenAI

to own 10% of AMD. Reaction is AMD +27% and NVDA and AVGO lower. OpenAI

deals at this point are becoming very confusing as is the source of all the

capital. MU +4.7% on an upgrade:) MAG7 are led by TSLA which fell Fri after

release of sales data (440 key). Speculative tech stocks are bid with drones,

bitcoin related, rare earth names higher. RCAT was Fri’s idea of the day +9.3%

and the USA govt is reported to be discussing a deal with Ukraine. Quantum

stocks are lower with QUBT-13% with a secondary. Many of the meme names are

profitless and often use pops to sell stock. Retail doesn’t care about

fundamentals so may buy the dip. Bitcoin and precious metals are higher in

spite of the macro which in theory should be negative. For now the flows are

dominating and without any economic data or earnings releases, the market can

operate in casino mode but spidey senses are elevated when moves don’t make

sense. SPX 1m correlation is very low, single stock IV is elevated relative to

SPX and in many cases tilted to calls vs puts. This is a set-up for a blow-off

top or a flip of the canoe in the event of something negative. Call verticals

are a lower risk way to participate in the upside when things don’t make sense.

QQQ is at the upper daily expected move premarket so primary thought is a

pullback but alternate thesis is they continue to drive it higher so some

caution is warranted IMO if chasing.

SPY 671.5 with Resistance at 672.5 and 675 and Support at 670, 669, 668,

and 665 QQQ 608.15 with Resistance at 608 and 610 and Support at 608 and

605

Daily Expected Move. SPX(6749-6683) SPY(672.5-666) QQQ(608-599)

IWM(248-244)

Stocks to watch TSLA, AMD, PLTR, MU, NVDA Speculative EOSE, PATH,

RCAT, QUBT, IONQ

Pre-800ET

Indices UNG, ARKK, ARKQ, ARKF, SMH, ARKX, ARKG, GDX, NUKZ, QTUM, TLT, KWEB,

FEZ

S&P500 AMD, MU, SMCI, PLTR, TSLA, NVDA

Other EOSE, PATH, RCAT, CIFR, IREN, USAR, CRCL, MBLY, RIOT, BMNR, ACHR, CLSK, SBET, MARA, QUBT, IONQ, RGTI

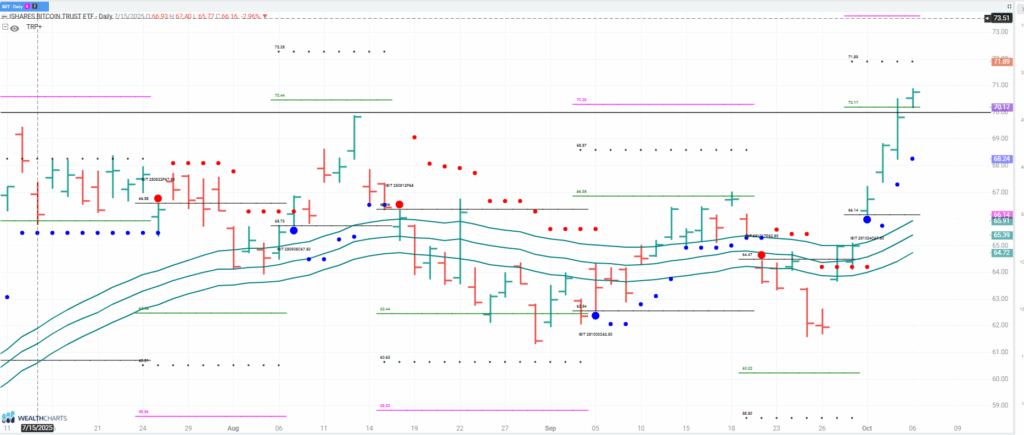

IBIT

Bitcoin surged last week and is continuing premarket. Large IBIT call positions at 70 can lead to squeezing higher and lifting the meme names like MARA, MSTR, BMNR etc. US$ is notably higher today which is normally negative but it looks like flows are dominating. If wish to chase, call verticals have a higher than average reward/risk ratio since the OTM calls are trading at a higher IV. Alternatively can wait for a pullback with 70 the level to watch.