Swing Trade Ideas – October 17, 2025

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong Kong – Negative set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

· Yields: 30Y Bond -0.29% Currencies: USA$ +0.05%, CAD +0.1%, YEN-0.05%, BTC/USD-2.2%, Vix: 23.45

· Stocks: AXP+0.4%,

ALLY+5.3%, CSX+2.8%, IBKR-1.6%, STT-2.6% EPS

Events: USA: Trump and Bessent busy tweeting that talking to

China today and will meet with XI.

Equity: Global indices were lower overnight post Thurs pullback of USA

indices. QQQ bounced off the put wall as the White House has been busy tweeting

that Bessent will talk to China today and Trump will meet with XI in two weeks.

Thurs regional banks’ concerns rose with Zion and Wal announcing fraud issues

which compounded two prior private credit issues leading to bankruptcies. Today

several regional banks reported and did not report any new issues which has

quelled the drop in financial stocks today. Vix futures were inverted this

morning with short term Vix futures > longer dated indicating short term

risk concerns. Today watch Vix as a surge higher can lead to a

retracement or conversely a fall is positive for equity. SPX 0DTE positioning

is indicating 6645 as upside resistance, but not seeing any downside support as

put sellers have not been active hence potential for sharp drawdown. SPX6600 is

a pivot level to watch today. MAGS are generally weak with ORCL lagging after

releasing at 2030 forecast where they are trying to counter the notion that

margins will be poor given the capex, I guess it wasn’t convincing. MU is lower

on halting server shipments to China after China banned them in 2023:) Quantum

names are bid premarket after Thurs premarket bid followed by RTH slamdown.

Bitcoin continues to slide, which is leading to the miners pulling back. Silver

and Palladium are taking a breather after a torrid squeeze. There are some

signs of concern in the financial plumbing with liquidity less abundant, which can

add to volatility and likely will lead to the Fed acting. Today is Opex so may

see some intraday volatility and expect WH tweets to spice up the day.

SPY 660.6 Resistance 662 664 669 670 Support 655 652 650, QQQ 599

Resistance 600 605 609 Support 599 595 590

Daily Expected Move. SPX(6707-6550), SPY(669-652), QQQ(609-591),

IWM(249-241)

Stocks to watch CSX, AXP, ORCL, NVDA, MU Speculative LUNR, SMR, CCCX, IONQ, QUBT, UAMY, USAR,

CIFR Pre-800ET

Indices KRE, XLF, XLE, XLU, US$, GDX, IBIT, ETHE, KWEB, XME, SLV,

ARKG, SMH

S&P500 ORCL, HOOD, MU, COIN, UNH, INTC, PYPL

Other LUNR, SMR, CCCX, IONQ, QUBT, OKLO, PGY, STLA, UAMY, USAR, CIFR, CLSK, CRML, NVO, WULF, RIOT, NVTS, ASTS, MP

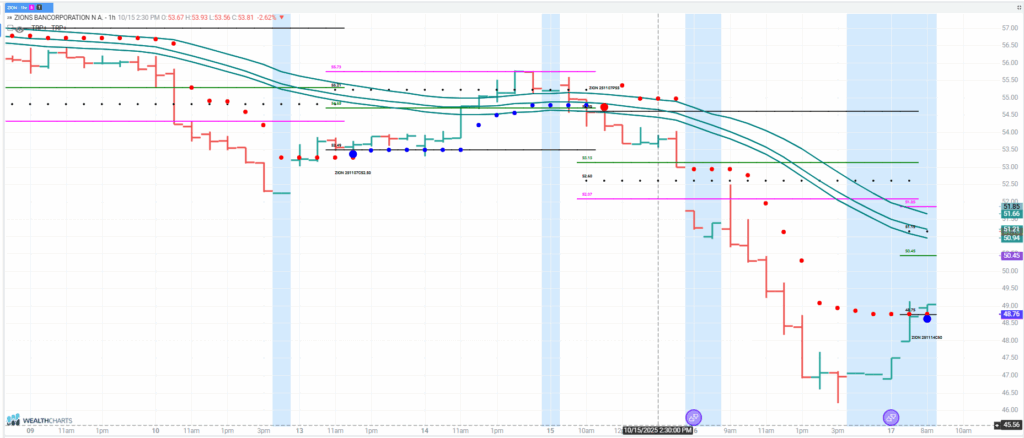

ZION

ZION fell Thurs after announcing a $50M bad loan due to fraud which is adding to the private credit unease. It’s a $8B company so not a major financial risk but more so the risk of more cock roaches. ZION is bouncing premarket (short cover) off the 45 put wall. Straddle approach possible with long > 49 with potential that put holders close positions. The next level of support is 47.5 which is the limit for a dip buy. Below that level can retest 45. KRE is an alternative way to trade regional banks with risk that there are more cock roaches in private credit.