Swing Trade Ideas – November 5, 2025

Date:Nov 5, 2025

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong Kong – Neutral set-up

- Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

- Yields: 30Y Bond +0.03% Currencies: USA$ -.05% CAD -0.22% YEN-0.06% BTC/USD+2% Vix:19.8

- Stocks: AMD-3.3% SMCI-7.2% PINS-18% MCD+.5% U+16% LITE+15% DOCN+9.5% EPS

Events:USA:ADP jobs 830ET; ISM services 10ET

Equity: USA indices are rising premarket after selling down overnight. Catalyst was a 4.6% drop in the Nikkei with AI/tech stocks falling led by Softbank the ORCL stargate partner pledging Billions and raising debt with stock holdings as collateral. SPY hit the 670 put wall and reached the bottom of the daily expected move and now back to 675 which is the pivot level to watch. Currently IWM and ARKK leading and TSLA leading MAG7 which is a set-up indicating short covering or hedge funds continue to degross (Sell longs, buy shorts). The move in Nikkei overnight is a warning and indicative of the impact of foreign investors that are part of the AI bubble and how some of these leveraged names like Softbank can cause contagion. AMD lower despite beating expectations continues a trend where high valuation names have trouble on beats. PINS is another example of where earnings misses are harshly treated. Vix futures moved above 20 with the Japanese issue but with ADP jobs better than expected, it is falling, which is supportive for equity. SPX 0DTE looks potentially choppy 6800-6750 with premarket suggesting higher, which is what falling IV will support. ISM services PMI at 10ET may be market moving and Trump at 13ET is another risk. Bitcoin and gold are both bouncing premarket with the former lifting all of the usual suspects and COIN leading the S&P.

SPY 675 Resistance 679 680 Support 670 QQQ 617 Resistance 621 625 Support 610

Daily Expected Move. SPX(6825-6718) SPY(681-670) QQQ(626-613) IWM(244-238)

Stocks to watch TSLA IBIT HOOD COIN AMD SMCI PINS Speculative LITE U CSIQ

Indices ETHE IBIT GLD ARKK IWM UNG ARKG XLK UFO XBI

S&P500 COIN MU HOOD TSLA SMCI AMD PLTR

Other LITE U CSIQ ZETA TEVA DOCN SMR RIVN BMNR JOBY IREN RGTI QBTS BHVN TREX PINS UPST SEDG AG

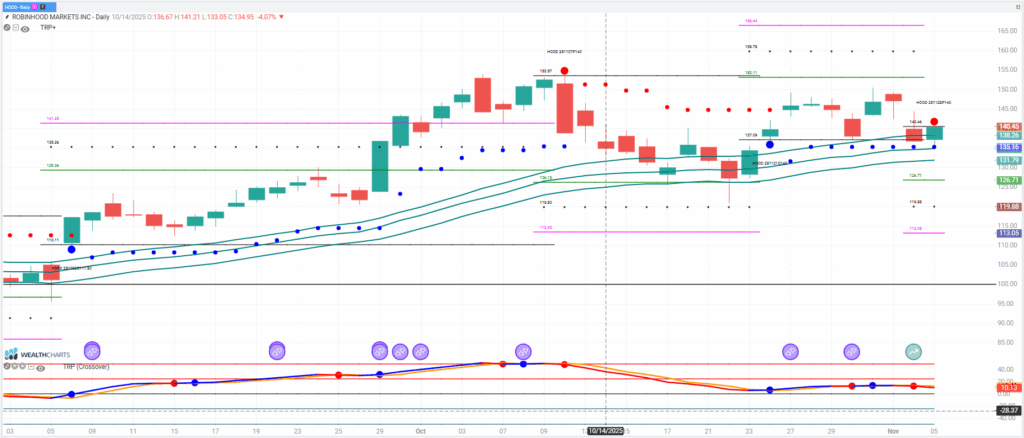

HOOD

Reporting after the close. Premarket the monkeys are buying with long idea above 140. Expected move +/-12.5. Call wall is 150 which can act as resistance or squeeze above due to positioning. Put wall 135 with acceleration below. Positioning is skewed to calls and HOOD is a fave of monkeys . Calendar/diagonal is a strategy due to the elevated vol this week.